Canada's public sector - a diminishing benefit

Time to innovate

Employment in the public sector accounts for roughly 22% of employment in Canada. The number itself isn’t that unusual as it has fluctuated around this level for 30 years, even reaching 26% at one point. The question is does it have any fiscal or efficient validity to stay at this high level. What is the cost benefit to Canadians.

This high number of public sector employees can be somewhat rationalized when the operational aspect of providing services was more manual and less technologically enabled. It’s not the case anymore, at least it shouldn’t be.

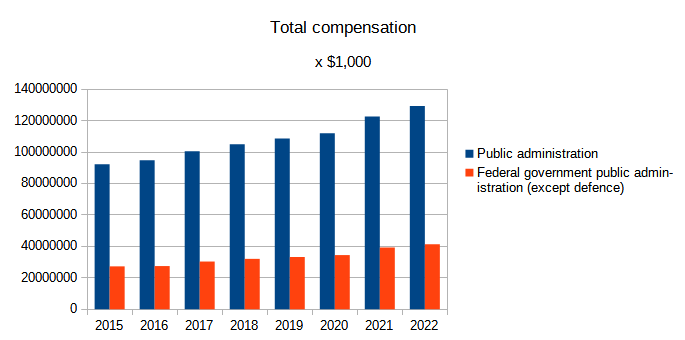

Public sector employees are a hard cost to Canadian taxpayers. A hard cost that is all but guaranteed to increase; salaries, pensions, benefits. The total compensation of public sector administration went from ~$92B in 2015 to ~$129B in 2022. The federal government administration’s compensation share of it went from ~$27B to ~$41B over the same time.

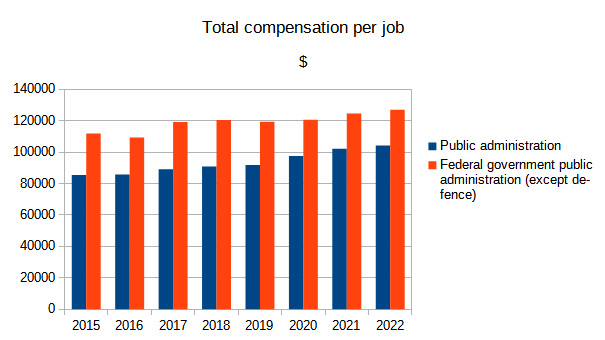

The total compensation per job has also soared to over six figures, and it will be higher based on the recent negotiations with Unions. Another way to look at it is the cost per job (and/or employee replacement) to deliver the services is at an all-time high.

The escalating cost to deliver services isn’t reflected in more services or a higher value of services. Thus it’s a diminishing marginal return to taxpayers.

The nominal value of a $2000 (just a numerical example) CPP benefit has absolutely no ties to the cost of its delivery nor should it. However, the cost of its delivery continues to grow. In essence, this is how the loss in productivity, and the diminishing return of tax dollars to service benefits happens.

The whole performance of the public sector has to be reorganized with consideration to how much dollar value of service per employee a Canadian gets. This should be the leading KPI. And since most of the services they offer are digitally based it is time to become high tech.

The hourly productivity of federal government services has gone down from $82/h in 2015 to $79.9/h in 2022. The annual average of hours worked in the public sector has dropped down from 1701 in 2015 to 1692 in 2022. It just doesn’t make any sense to spend more and get less productivity out of it.

Wasted taxpayer dollars aka government revenues on inefficiencies means there is a direct missed opportunity to utilize the sums in more benefits, greater benefits, or lower taxes. Lower taxes, imagine that.

This will be a tough task for a willing government but a crucial one to protect the future fiscal well-being of Canada.

More can come back to Canadians from the government if there is a smaller government, perhaps an oxymoron for some.