Budget 2025

Thoughts and analysis.

Federal Budget 2025 is Canada’s first budget in 18 months, and it is an important one. For most of 2025 the Liberals would remind you every turn they get that we are in a crisis, so the budget should reflect truly transformational action, right? Let’s take a look.

I won’t get into some of the financial ratios in Budget 2025 of Canada’s financials comparison with the other countries, because I could write a whole article just on that, but it is important to point out that the quoted net debt to GDP ratio of 13.3% is wrong. The Federal government uses pension assets (CPP, QPP) as part of that calculation. Excluding that, the ratio is around 46.1% as of Q2. Then there is the provincial debt.

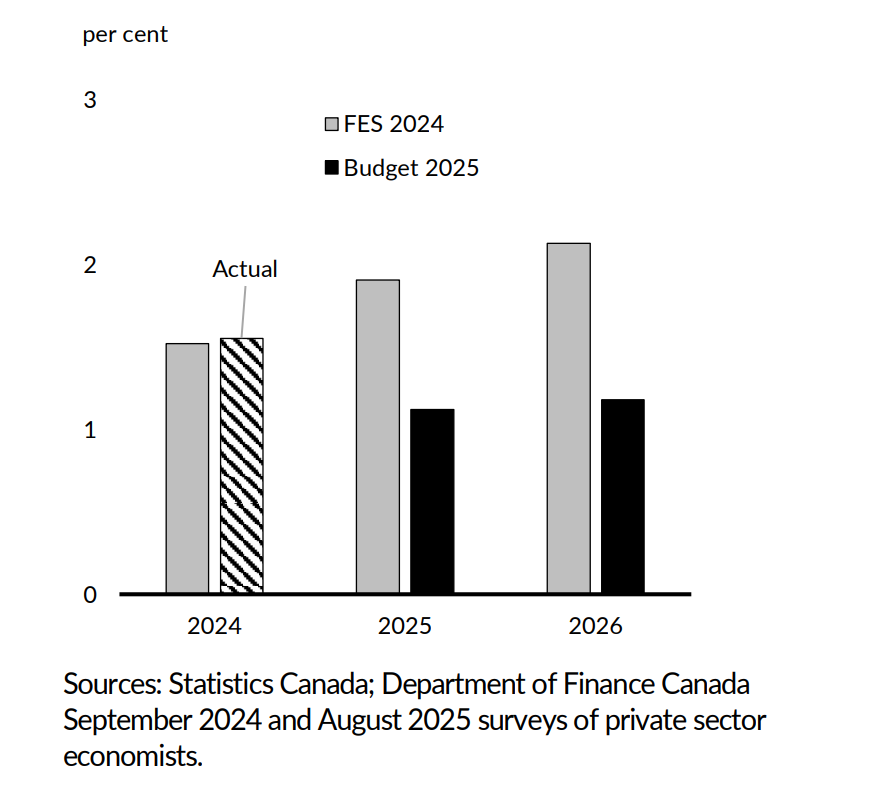

The 2024 Fall Economic Statement had Canada’s Real GDP projected at around 2% for 2025 and above that in 2026. Now, this budget revises it down by half to just over 1% growth. They also stated that the risk to growth and inflation has increased. Inflation has definitely been accelerating over the last couple of readings. Not sure how they don’t think that spending over $500B won’t have an impact on that or on our dollar.

The budget aims to reduce the costs of day-to-day government operations and to turn these savings, plus additional borrowing, into capital investments, where it believes it can achieve a multiplier effect. In general, it is a good move as operational costs should be minimal, but the question is whether the “investment” spending will generate sufficient ROI to make drastic changes.

It is important to note that the ROI on investment will vary depending on other factors that hinder it, such as red tape. To get the multiplier effect, the capital still needs the private sector to substantially increase investment in Canada. The plan is $280B over 5 years on new infrastructure projects, which is $450B on cash basis.

Deficits:

2025/26: $78B

2026/27: $65B

2027/28: $64B

2028/29: $58B

2029/30: $57B

That’s an additional $322 billion in deficit spending with no plan for a return to balanced budgets. The operations side is aimed to be balanced with revenues by 2028-29; everything above that is pure debt. They think they can generate $500B in additional private investment over the next 5 years. It is very doable, without red tape.

The government will find operational savings by launching an Office of Digital Transformation that will digitize, adopt AI and innovate government operations so they are not as personnel-intensive. They are planning to shrink the federal bureaucracy by about 40,000 people from its peak over the next 4 years, which will be part of the $60B in savings under its Comprehensive Expenditure Review.

This will give a boost to Canadian tech companies if the federal government will source Canadian as they promised, and I hope they can avoid ArriveCan type of scandals in the process. I will expect some things to get broken along the way, as government operations are years behind the times, and there will be friction to get them up to speed. This is a necessary step regardless if we want a move towards efficient government operations.

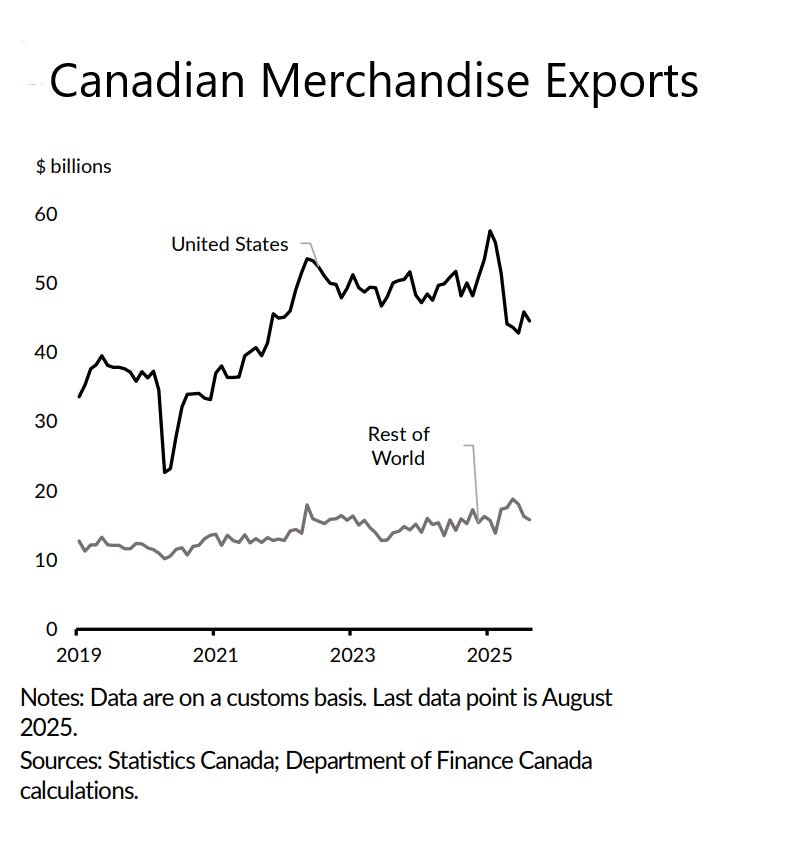

Canada’s economy desperately needs to manufacture things again, build things again, and develop new export capabilities. There is a lot of blame going on in regards to our economy on Donald Trump’s tariffs, China’s tariffs, etc. And they are definitely having an impact, but the reality is that our exports haven’t been growing in years. We can’t export more if we don’t have more things to export and a way to export them to new markets.

Based on private sector forecasting, Nominal GDP is now projected to be lower than the Fall Economic Statement of 2024 by $40B on average every single year from 2025 to 2029. The Budget 2025 correctly points out that low productivity is one of the pain points of the economy and standard of living.

Business investment has been flat for a decade, and investment in machinery in particular has declined by 50% over that time. This is something I’ve worked on and have been raising the alarm about, and I am happy this is being noticed and is being addressed. We can’t grow productivity and economy without being investable. They assume $480B in growth just from this aspect.

Navigating red tape on how to actually build anything in Canada is a major choke point for investment. Federal regulatory burden has increased by over 37% since 2006 and our business investment would have been 9% higher without that increase. Even though the government knew the data they did nothing about it. The Building Canada Act and Major Projects Office will try to fix the bed they made.

Earlier in the year Mark Carney instructed his Ministers to find red tape to eliminate, and they found 500 improvement points to reduce regulatory red tape in just 90 days. Which makes you wonder what they have been doing for the past 10 years.

The Major Projects Office, which isn’t needed unless duplicate roles will be terminated from elsewhere, will help identify Canada’s national interest projects, which we can all identify without that office, and the projects that have been identified so far have already started a while ago. The MPO will get $213.8 million over 5 years to make it a single point for approvals and financing.

The thing that is the hardest to navigate in building projects that no one wants to talk about is First Nation issues. In the Ring of Fire area, Ontario has been negotiating to build a road for 20 years. The Indigenous Loan Guarantee Program has been doubled to $10B to give them money for equity for new projects to get things going. There is a word for that, but now it is business as usual in Canada.

Productivity Super-Deduction is being introduced to offer aggressive tax incentives and write-offs at accelerated times. Immediate expensing of manufacturing machinery and equipment, ZE vehicles, clean/conservation energy equipment, computers, patents, and R&D expenses. I completely support all of this. These are among the most important points in the entire budget to attract private-sector investment.

Canada’s marginal effective tax rate (METR) will drop by 2%. Enhancements to the SR&ED program will help increase R&D investments and especially when the program is now extended to eligible Canadian public corporations. Processing time is being cut in half from 180 days to 90 for expenditure reviews, thank goodness.

The Liberals are launching Build Canada Homes with $25B to attract private investment to expand housing supply. They claim a 50% reduction in building times, a reduction of costs by 20% and emissions by 20%. This policy isn’t needed at all. It essentially aims to subsidize building modular home construction. Builders that will qualify for it will get their projects subsidized vs builders who won’t, making it all seem unfair. It’s a stimulus to a newer industry, and should be viewed as such.

This new housing strategy is pulled back from previous promises and continues to use stats that they already failed to achieve.

Reducing immigration numbers is the best way to reduce housing costs. Getting municipalities to reduce development fees and time, which is where the main costs for the industry are, is the other key. None of that costs money to taxpayers. However, they think that this $25B program will yield a total investment of $130B. The question to ask then is, what will happen to the overall market?

Housing starts are averaging 277,000 units per month over most of 2025 so far, which are strong numbers. The real estate market has already shown a strong pullback from record purchase and rent prices. If the Liberals cut immigration as they promised, this will help reduce the artificial stimulus. We need the markets to self-correct.

The immigration plan proposed under the Budget 2025 is a bit of smoke and mirrors. It is doing a good job in reducing temporary residents, especially student visas, down to 150,000, which will have a significant impact on real estate in certain areas and sham colleges. The focus moves to economic migrants, which is just as easy to scam, and these numbers will increase.

The unemployment rate is only projected to decline to 6% by 2029. The labour pain Canada is facing is a multi-year one. We don’t need more economic migration. Removing these down to the most unique STEM positions is what will help clean out our labour market and increase investment in innovation instead of relying on cheap foreign labour.

Permanent resident admission will be higher than what was even in Justin Trudeau’s revamped plan in the upcoming years. They also want to jump the line and convert some refugees and work permit holders to permanent residents, which doesn’t reflect in their projections. But none of these numbers will be accurate if the chain-citizenship Bill C3 is passed anyway.

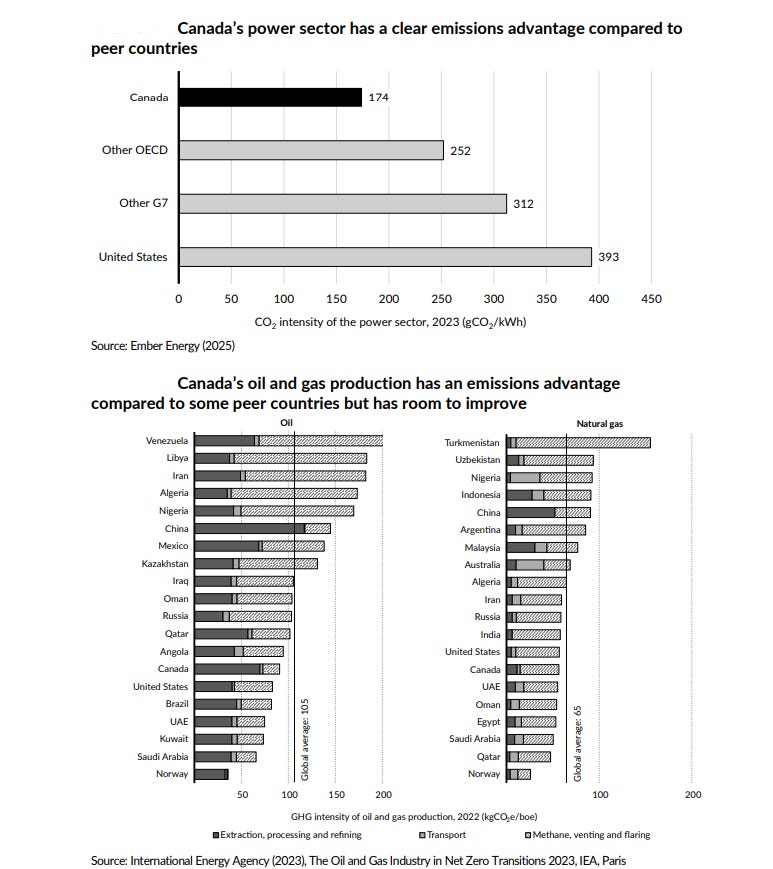

The cornerstone of this budget that is undertalked about is the Climate Competitiveness Strategy. Mark Carney, who has been architecting global carbon tax based trade before becoming Prime Minister, campaigned on the industrial tax. They just didn’t have the political or mechanistic opportunity to implement it yet. Even though the majority of the world’s economies and trade don’t care for this, Carney is pushing this because Europe is implementing it, and thinks it will make us more competitive.

Canada’s energy and oil and gas production is already more environmental than the average and our industrial competitors, giving us already an edge as a choice for these countries, he claims, asking for a ‘greener’ choice. But that’s not good enough because they view carbon capture as an industry that allows us for resources expansion even though it is not economically viable otherwise.

Net zero by 20250, which will be led by the industrial carbon tax, which the federal government will try to harmonize across Canada. The claim that the Oil and Gas Emissions Cap will “no longer be required” isn’t a commitment to get rid of it; they just mean no new production will happen without carbon capture and storage investment alongside it. Alberta Oil Sands Pathways Plus projects essentially does that.

Clean Energy, Clean Technology Manufacturing, Carbon Capture, Utilization, and Storage (CCUS) tax credits are a massive bet in the budget to attract investment into Canada.

Natural Resources Canada will create a $2B Critical Minerals Sovereign Fund, which will make strategic investments in critical minerals projects and companies. This is similar to what Donald Trump has been doing in the US recently. I am not against this and would argue there is a strategic case for it, and that it makes a stronger financial case for an ownership position than just giving out capital at a cost. However, it won’t be all equity stakes.

The budget has a good focus on critical minerals project development it is just too small. It needs to be much greater, as these are long-term projects and will position us in a unique global power spot. This area, and supporting it with infrastructure, is where most of the new spending should be focused, but unfortunately, it isn’t. This is an incredible opportunity to develop rural communities as a byproduct, which will further reduce demand for housing in major areas.

Canada signed the 2% of GDP investment in military investment commitment and the NATO Defence Investment Pledge that will reach 5% by 2035. This new capital coming into our Canadian Armed Forces is critically needed as for years it has been neglected, mismanaged and as a result, not only are our men and women in uniform suffering, but also half of Canada’s already ill-equipped military isn’t functional.

$81.8B over 5 years on a cash basis will be invested in the Canadian Armed Forces capabilities. Some of it is going towards recruiting and salaries, some of it towards modernization, but not enough of it is going towards hardware and actual operation capabilities.

Nonetheless, this new capital injection into such a niche sector will help develop specialized talent and new tech companies. Investing in this ‘complex’ yields new growth that isn’t possible otherwise, and it is well needed.

There are other great niche-focused initiatives in this Budget 2025 like changes to the banking industry that will help fintech and consumers, harbours, and things like Artist’s Resale Right.

The problem with this budget is that with all these talks of crisis, it doesn’t take massive and pivotal enough steps to make drastic changes and huge leaps for the record debt Canadians will be left with. They are only estimating around $3B in growth from corporate tax revenues over the next 5 years…on apparently $1T of total investment. Some of the yields and costs don’t align.

The initiatives here often take a turn right before maximizing impact; we are not getting rid of red tape and pain points fast enough or permanently to really welcome and unleash investment. Some of the measures that should be permanent are temporary. Unlike the previous budgets, at least this budget finally addresses actual developmental needs, and I think it will achieve that.

We really need to move away from the creation of bureaucratic agencies and committees to generate change. Just get things done without wasting that time and money. It would have been nice just to have a window-friendly structure for industries and small businesses to deal with that doesn’t require so many touch points with the government.

The well-being of Canada’s social fabric is ignored, and the main tax cuts are for yachts and jets. Initiatives can’t be all welfare-dependent. We needed structural changes here to help reduce the burden of taxes on Canadians and invest in organic population growth.

The end results of this budget will be $1.8T in net debt at the federal level and $76.1B in costs just to carry our debt, which will cost more than we will spend on health transfers.

Mark Carney asked our future generations to prepare to sacrifice for this budget, but nothing is assuring here for future generations except that a hope at a job if the gamble works out. We are not building generation wealth but trying to avoid a collapse.

Once our mindsets pivot from survival to the fact that we should be and can be the richest country on earth, so will our policies. For that, we need unapologetic ambition. Budget 2025 isn’t it.